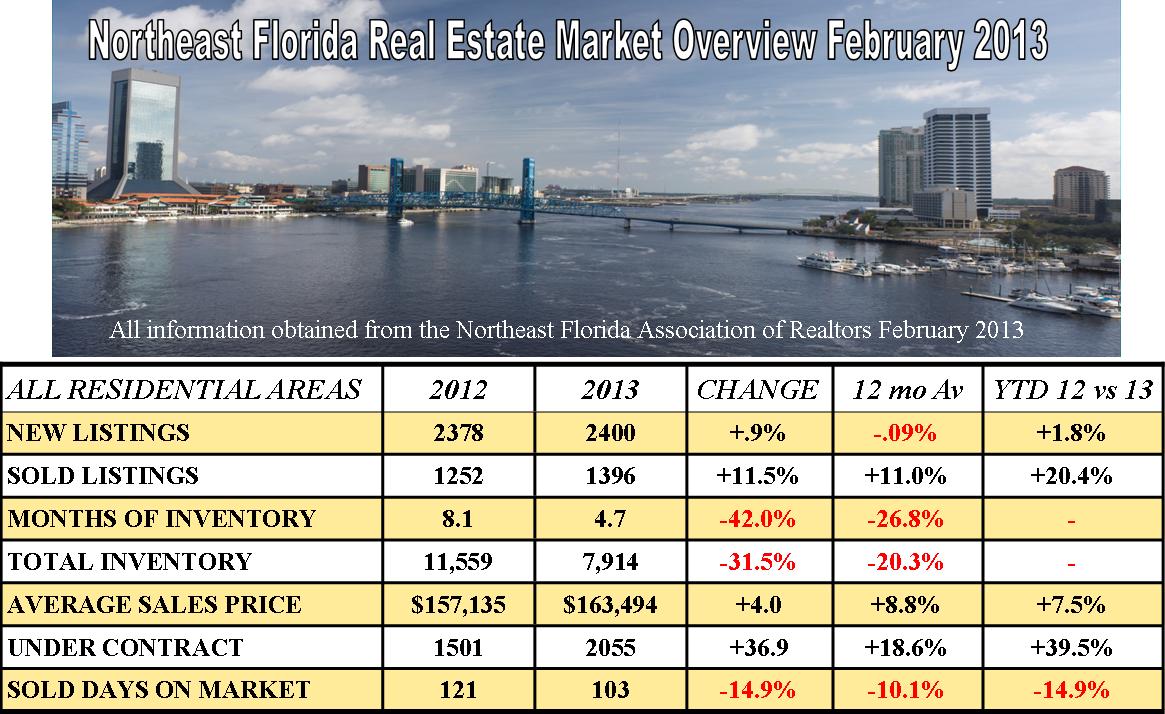

Jacksonville Real Estate market Statistical Overview Feb '13

SALES RISE HIGHER THAN INVENTORY LEVELS CAN HANDLE

Our inventory levels are down 20.3% and the sales have increased 11% parroting last months more of the same. We have to get higher gains in our inventory as the days on market keep decreasing to keep up with this demand. The FHA lending changes on the horizon will eliminate some of this buyer pool and may result in a slow down of the increasing average sales price,. As things level out to the change in the amount buyers can qualify with the increase in the monthly mortgage insurance.

This change, effective April 2013, will decrease a buyers ability to purchase (given our average sales price and current interest rates) by 2%. Also many lenders are decreasing the back end ratio’s for qualifying which in turn could decrease the buying capabilities of most buyers by an additional 2-4%. Having those on the horizon will directly effect the market as FHA loans are the most affordable and easiest to qualify. Most buyers, especially first time homebuyers, which nationally make up 39% of the market use the FHA loan products.

Now is a GREAT time to sell your home, if you were looking for a high buyer audience then wait no more. The average days on the market is decreasing and prices are inching higher given the competition for homes priced well and in marketable condition. If you have a fixer upper, no worries, with renovation financing available even for FHA making cosmetic or even major changes can be obtained through the buyers financing instead of sellers making these repairs up-front and can be done AFTER closing.

For more information on your homes value, or these financing programs contact me, I’d be happy to assist you in all of your real estate needs, real estate investing and property management needs.

Comments (0)

Please contact us if you have any questions or comments.