The Hetman Home Team

https://www.homesinjacksonvillefl.com/blog/2019-annual-report-on-the-northeast-florida-housing-market-for-residential-real-estate-activity-from-the-northeast-florida-association-of-realtors-mls

2019 Annual Report on the Northeast Florida Housing Market for Residential Real Estate Activity From the Northeast Florida Association of Realtors®MLS

Posted By: Rosie Hetman-Clemente In: Jacksonville Real Estate Market Statistical OverviewDate: Wed, Jan 6th 2021 1:34 pm

2019 Annual Report on the Northeast Florida Housing Market

FOR RESIDENTIAL REAL ESTATE ACTIVITY FROM THE

NORTHEAST FLORIDA ASSOCIATION OF REALTORS® MLS

Current as of January 8, 2020. All data provided by the Northeast Florida Multiple Listing Service. Report © 2020 ShowingTime. |

|

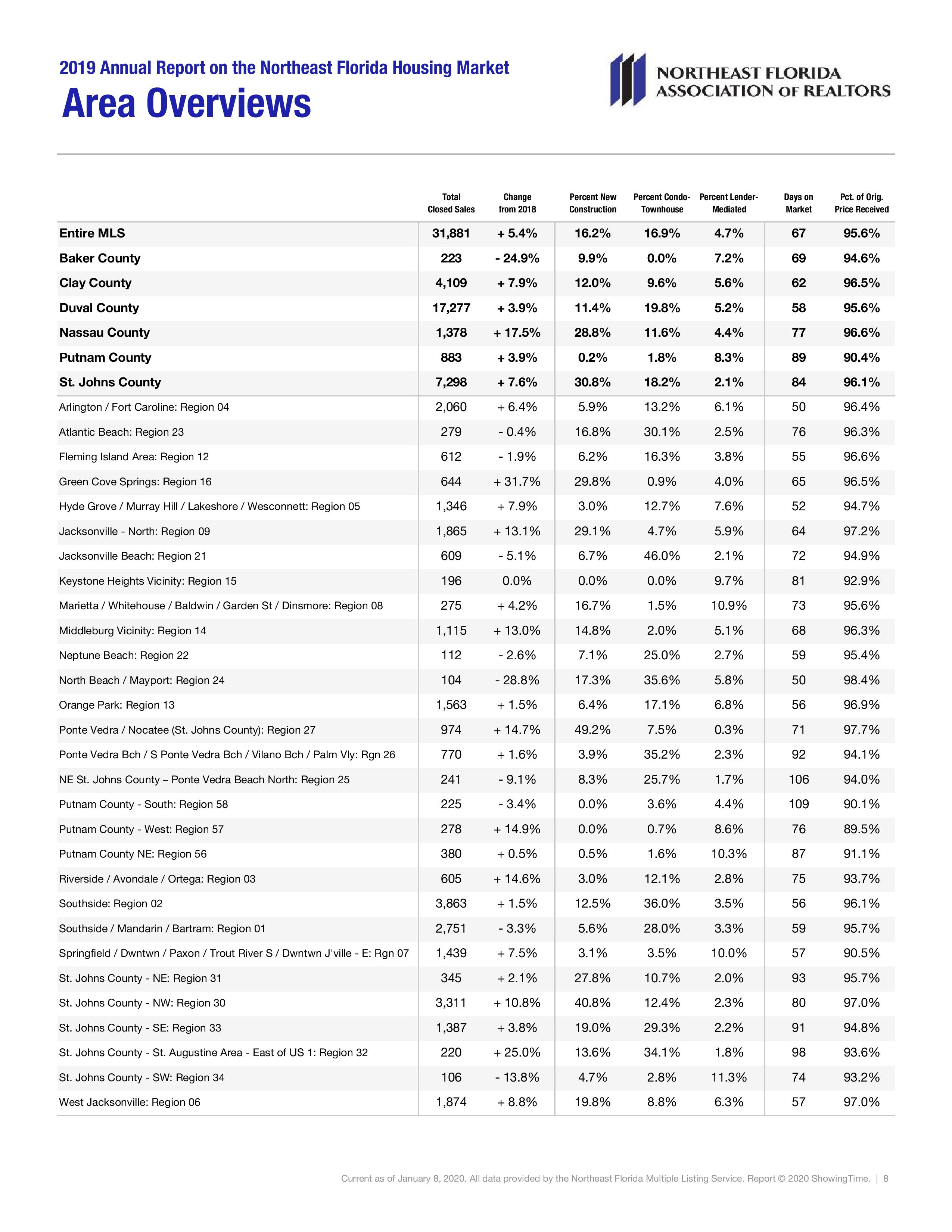

The 2019 housing market was fueled by the overall

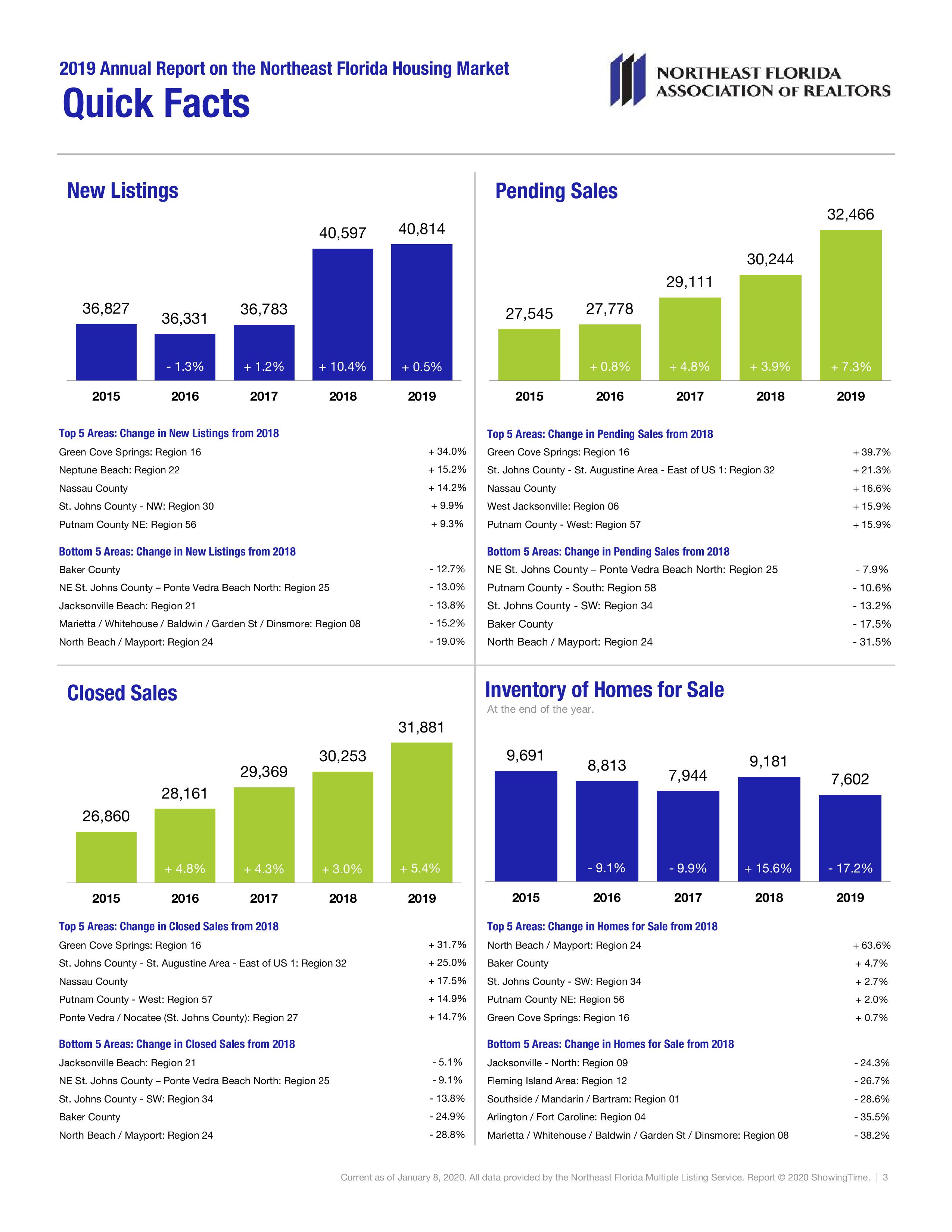

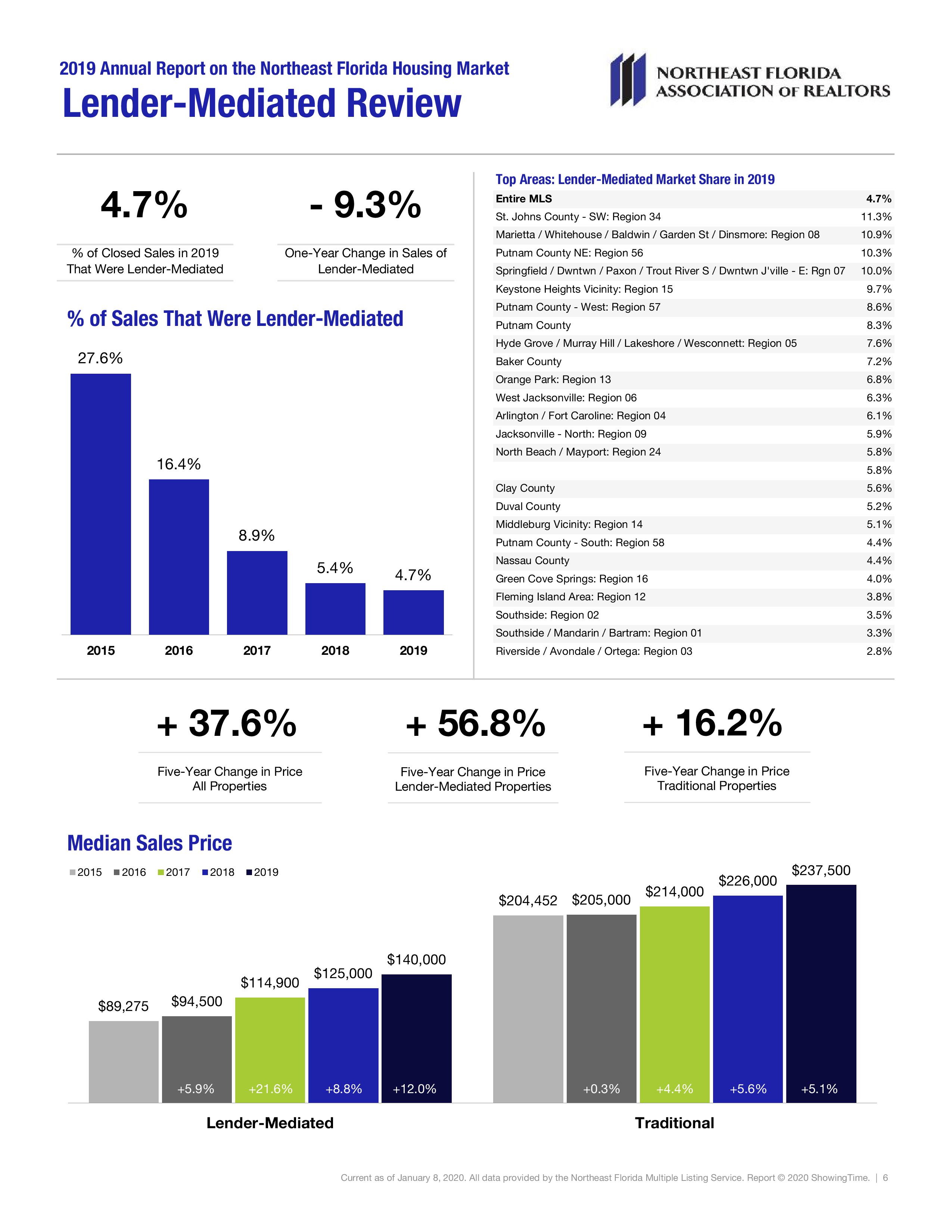

Pending sales increased 7.3 percent, finishing 2019 at Listings: Comparing 2019 to the prior year, the number of Lender-Mediated Properties: The foreclosure market |

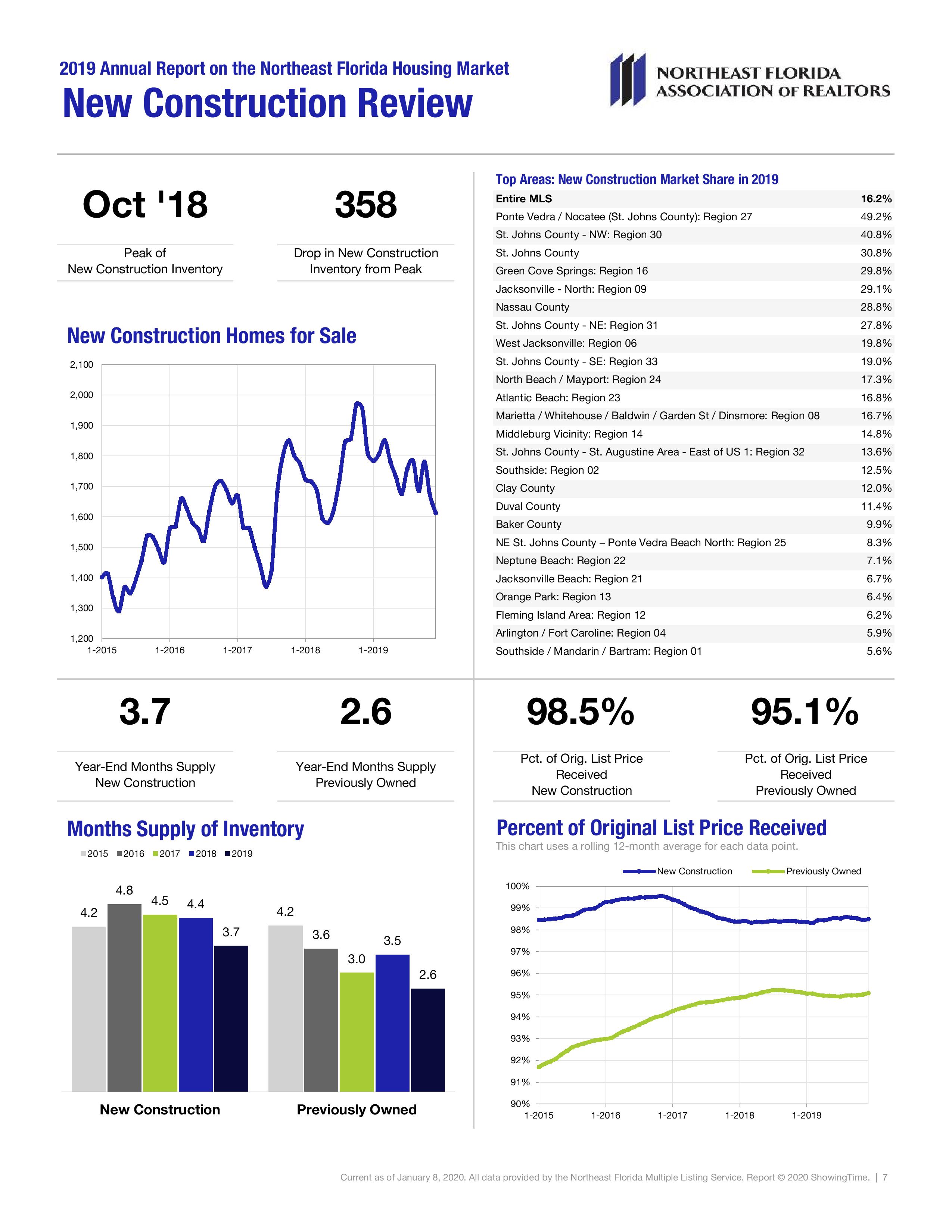

New Construction: : Nationally, builder activity grew in 2019

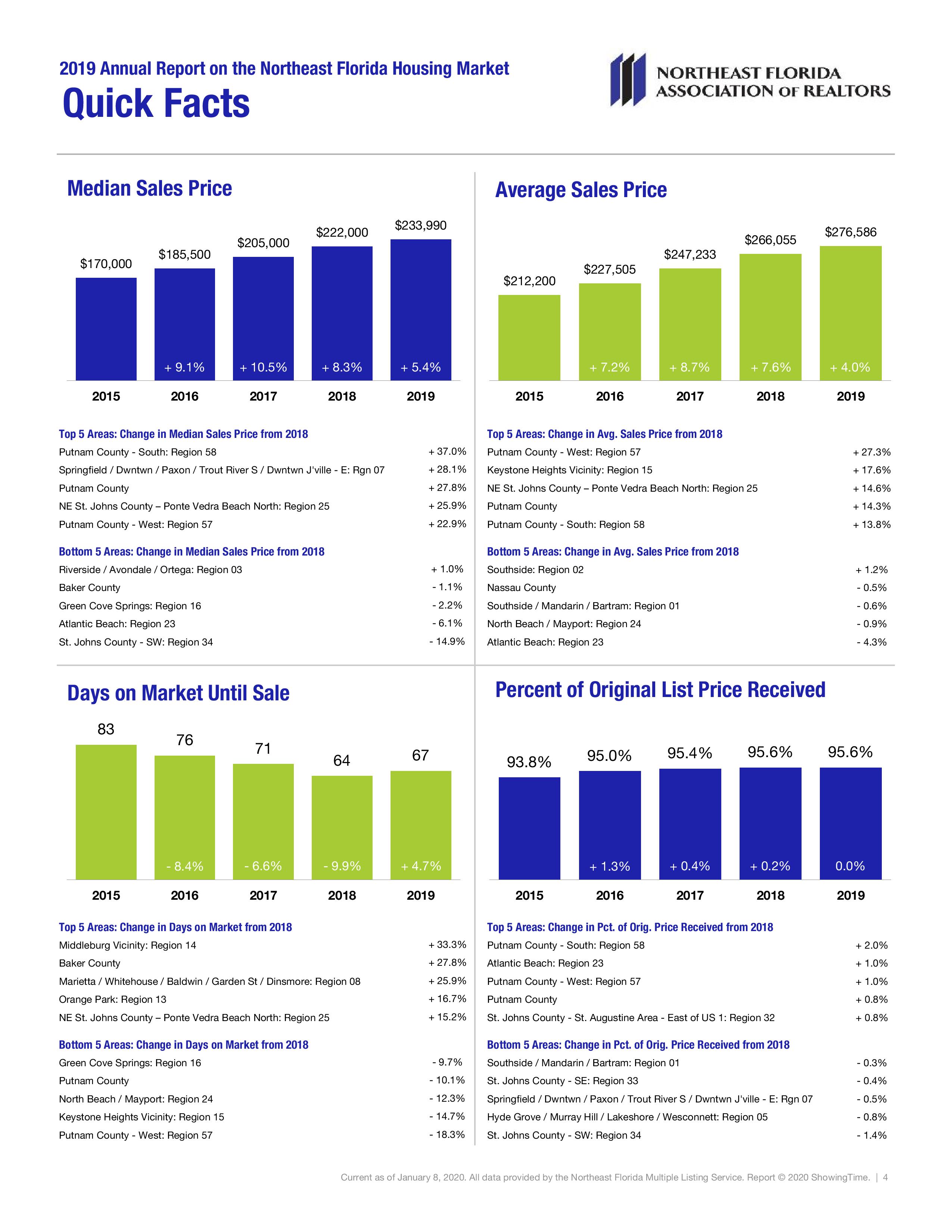

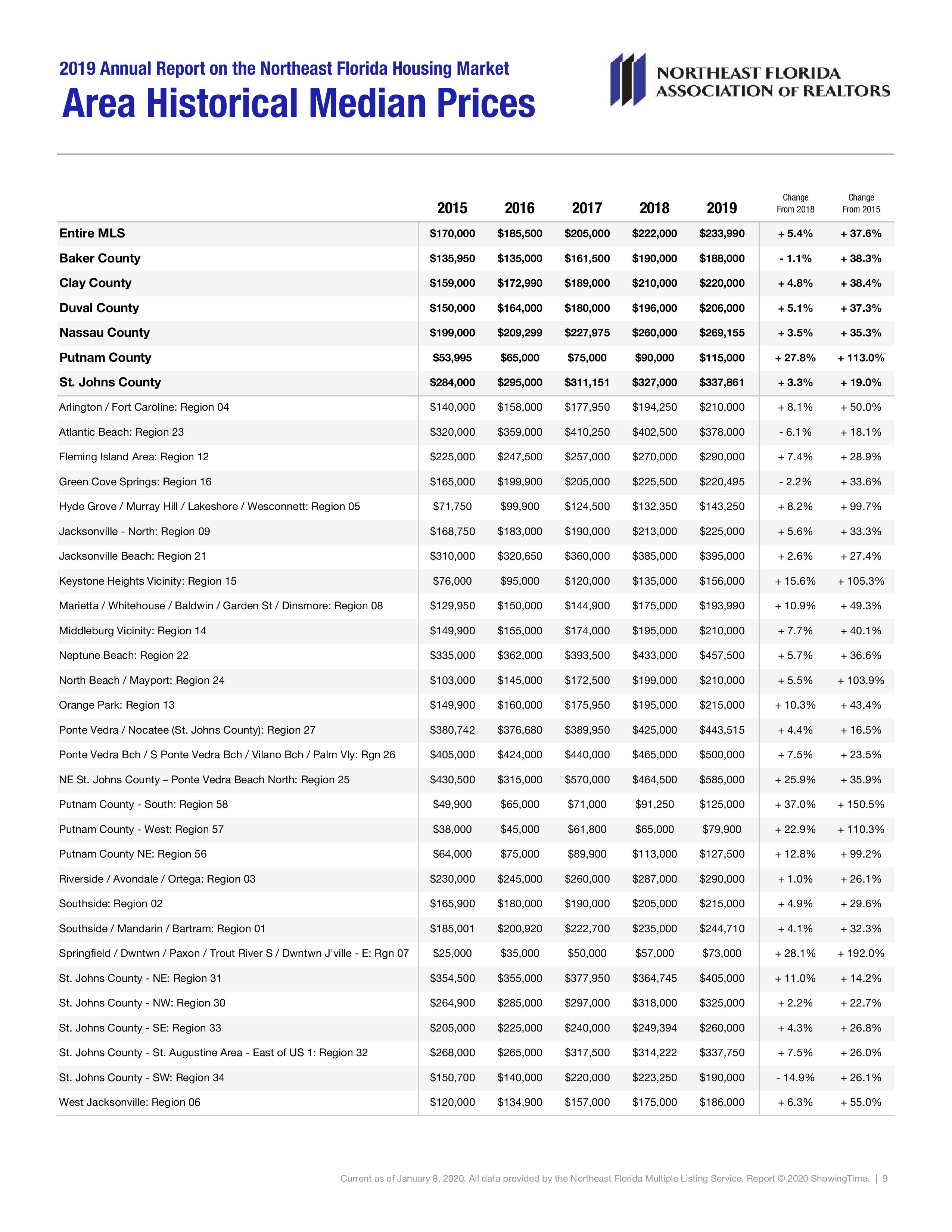

Home prices were up compared to last year. The

As we look at 2020, we see continued low mortgage rates and |

Source: Northeast

Florida Association of Realtors .

*All data represents Realtor-brokered activity of single-family residential, condo and townhome sales combined. As all Nassau and St. Johns County Realtors are not members of the Northeast Florida Multiple Listing Service – a wholly owned subsidiary of the NortheastFlorida Association of Realtors – reports do not represent the full extent of Realtor sales in those counties.

Source: Northeast Florida Association of Realtors.